|

| Maximizing Yield on Injective | by keyur |

There are million-dollar yield-earning opportunities in yield farming but many are still unaware.

- ∞%APY Thru Looping Strategy

- 50% APY on USDT

- 45% APY on INJ-USDT LP Farming

Ft. Hydro, Dojo, Neptune, Stride, Injera, Mito, Blackpanther & Kakeru.

Why Injective?

- Injective has been outperforming most of the other chains.

- The TVL has surged from $8M to $80M which is 10x and being the leading chain for the RWA Adoption that feels like it's just a start!

- Recently, Injective also achieved the milestone of 1B transactions.

But Where should you place INJ for the maximum benefits?

We'll start with safer options and move up to degen mode:

- Safe: Staking & Liquid Staking.

- Somewhat Risky: Lending & LP Farming

- Risky: Looping Method

Safe | Staking

- As Injective is a Proof-Of-Stake chain, Stakers & Validators are rewarded with INJ for validating the blocks and securing the network.

- By Staking INJ on-chain, You get voting power in on-chain governance ( 1 INJ = 1 Vote ).

- with the recent changes on INJ tokenomics, making it the most deflationary coin

INJ offers the highest APYs among other Layer1 chains.

Staking Options

- INJ HUB

- Keplr Dashboard

- Ninji Wallet

- Trust Wallet

- Leap Wallet

Guide for Staking on INJ HUB

- Go to Hub Injective

- Choose the validator

- Click on Delegate now

- Enter the amount & Delegate

Always prefer the validator with less commission, high voting power & higher uptime.

Safe | Auto Compound Staking

- Hydro offers Auto Compound Staking for INJ which is available only for a short time.

- Rewards generated from staking are restaked.

- The APY is 16% with a lock-up period of 21 days to unstake.

Guide

- Go to Hydro protocol

- Enter the Amount

- Read the terms & tick mark

- Click on Stake & Confirm the transaction

Safe | Liquid Staking

The major con of the staking is that they don't allow instant redemption. e.g., INJ HUB has a 21-day lock-up period after requesting undelegation.

In Liquid Staking, you get Liquid Staking Tokens when you stake INJ.

When you want to unstake your INJ, you can directly sell those LSTs for INJ and you'll be out from staking.

Key Players for Liquid Staking

dINJ | DojoSwap ( 14% )

hINJ | Hydro ( 10% )

stINJ | Stride ( 12% )

Guide for Liquid Staking INJ on Dojoswap

- Go to DojoSwap

- Head over to Earn > Liquid Staking

- Enter the amount & Stake

- Confirm the transaction

The Alternative Way

- Go to the Swap section

- Directly Swap INJ for dINJ.

Somewhat Risky | BlackPanther

Black Panther is an asset management protocol that allows users to deposit funds in vaults.

The Deposited Funds will earn Trading APY, managed by trading bots.

Strategies

- Market Making

- Arbitrage

- Grid Trading

Hyperstaking on Black Panther

Black Panther offers a combined APY of 24%:

- Trading APY: 20.3% ( When you deposit INJ )

- Incentives APY: 3.9% ( When you stake blackINJ )

Guide

- Go to Blackpanther

- Select Hyperstaking Vault

- Deposit INJ

- Go to stake option & stake blackINJ

Somewhat Risky | Lending Protocols

There are two lending protocols on Injective:

- Neptune

- Injera

How it Works

- Let's say I want to buy Ninja NFT but I've staked hINJ.

- Instead of burning my hINJ, the Lending Protocol helps me to add hINJ as ➛ collateral and borrow INJ.

- Here, I also earned Hydro Compounded APY from Neptune Collateral and also bought Ninja NFT with Borrowed INJ.

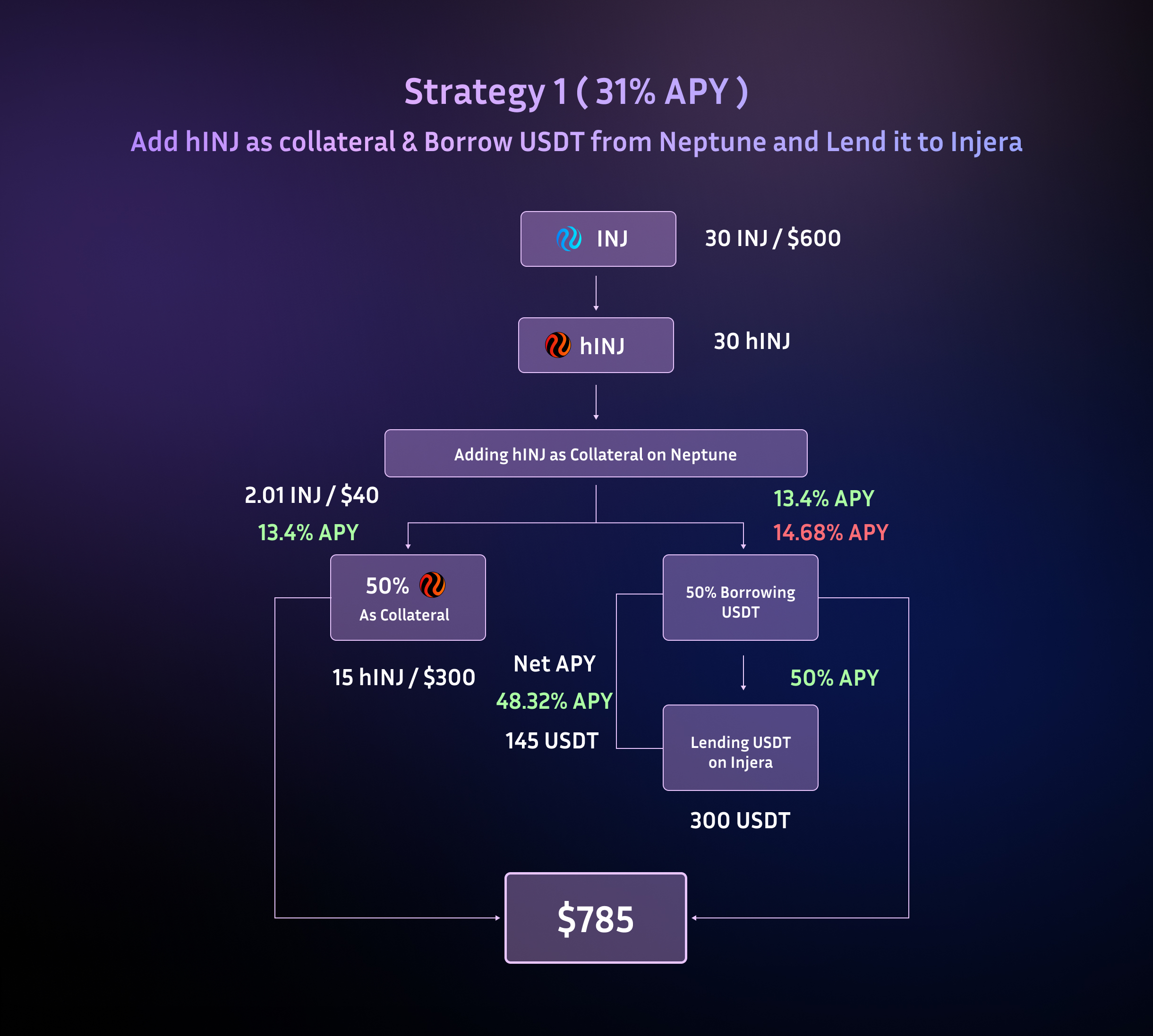

Strategy 1

Add hINJ as collateral & Borrow USDT from Neptune and Lend it to Injera ( 31% APY )

Calculation

- Adding hINJ as collateral for +13.4% APY

- Borrowing 50% as the USDT of the collateral for -13% APY ( Account Health = 2 )

- Lending USDT to the Injera for +50% APY

The avg. APY will be 31%. You can also borrow 80% as the USDT, but then 20% of the price changes will make the liquidation of your collateral value to repay the debt.

Strategy 1 - Guide

STEP 1 - Getting hINJ

STEP 2 - Addng hINJ as Collateral

STEP 3 - Borrowing USDT on Neptune

- Go to the borrow section in Neptune & Find USDT

- Click on Borrow and Borrow 50% of the collateral amount

STEP 4 - Lending USDT on Injera

- Go to Injera

- Find USDT in the supply section

- Supply 100% of the borrowed USDT

The Risk of Liquidation

When borrowing assets, you should understand the terms LTV - Loan To Value, Account Health, and Liquidation.

- LTV: The Maximum value that can be borrowed against collateral. e.g., if an account has $100 in INJ as collateral, with a max LTV of 80%, the account can borrow up to $80 in other assets.

- Account Health: Account Health measures the risk of liquidation.

Account Health = Total collateralized asset value / The Borrowed Amount - Liquidation: When the account health drops below 1, the liquidator uses the borrower's collateral to repay the debt.

Somewhat Risky | LP Farming

LP Farming is a key component of Decentralized Exchanges which allows users to earn rewards by providing liquidity to trading pairs.

DEXs give Liquidity Providers trading fees and other incentives in return as rewards

LP Rewards depends on the share of trading fees by DEXs and the TVL.

How it works

- Users provide liquidity to pair INJ-USDT on Dojoswap and in return, they receive LP Tokens representing the share of the pool

- Users stake these LP tokens to Dojo Farms

- Traders trade in INJ-USDT pair and share fees to Dojoswap

- Dojoswap shares some % of earned fees with Liquidity Providers in the way of LP tokens.

Strategy 2

Borrow INJ against hINJ, Mint dINJ, and Farm dINJ-INJ LP

Calculation

- Adding hINJ as collateral for +13.4% APY.

- Borrowing 50% in INJ against hINJ of the collateral for -4.8% APY ( Account Health = 2 ).

- Getting dINJ & Farming dINJ-INJ LP for 21% APY.

The Avg. APY will be 21% which is still better because you're first borrowing INJ against hINJ which has a very low chance of liquidation.

You're farming dINJ-INJ LP where you earn 21% APY in DOJO Token.

Strategy 2 - Guide

The First four steps we already covered in the above tweets:

STEP 1: Getting hINJ

STEP 2: Adding hINJ as a collateral

STEP 3: Borrowing INJ against hINJ

STEP 4: Getting dINJ from Dojoswap

STEP 5: Farming dINJ - INJ LP

- Go to Swap -> Provide Liquidity

- Select the Pair of INJ - dINJ

- Approve the Pair then Provide the liquidity

- Next, go to Earn -> Farm

- Click on ( + ) & Deposit the LP

Somewhat Risky | Mito Vaults

Mito's USDe/USDT vault is providing 34% APY right now. If you don't want to take the risk of liquidation on borrowing, This can be the best option. You also earn sats (Ethena labs

points ).

Guide

- Get USDT and USDe from Helix or Mito Swap.

- Go to Mito Vaults & Click on Details in the USDe/USDT vault

- Click on +Add & Provide Liquidity

Some other vaults on Mito with great APY

- INJ/USDT: 26.8% APY

- HDRO/USDT: 17.66% APY

- QUNT/USDT: 109% APY

Somewhat Risky | LSD-Fi - Liquid Staking Derivatives Finance

LRP is a ‘Restakable’ Liquidity Pool Token, which is an LST of staked LP. It offers some extra APY for Restaking Mito Vaults & Dojo Farms. Dojo's INJ/USDT Pool offers 40% APY and with Hydro's LSD-Fi, It becomes 44% APR.

Guide

- Go to Hydro's LSD-Fi section

- Click on Stake for INJ/USDT pair ( Dojo )

- Provide the LP & Mint LRP

- Stake the LRP

Risky | Strategy 3 - Looping Method

Here we'll apply the loop method while maintaining the risk of liquidation.

This Strategy is much simpler than it sounds ⏷

- Get hINJ

- Add it as collateral

- Borrowing 50% amount as INJ

- Minting hINJ with that borrowed INJ

- Adding it as collateral

The Avg. APY becomes 18% if you use 50% LTV.

Risky | Kakeru

Kakeru ( FKA Gryphon ) is another option for yield farming & lending/borrowing. It offers 400% APY on wnINJ-INJ LP ( it's insane ). However, the TVL is only $4K. If you find it interesting, you can check it out

DYOR

You're free to make your strategy. Take these strategies as an example. The APY changes frequently so make sure to change the strategy accordingly. The Looping Method may be risky if you're very new in DeFi & have less capital. Account health should always be above 2 in Neptune