The stock market’s secret trading hack has now landed on Injective. Exotic Markets is bringing a new way to leverage your $INJ on the market trend without having to worry about liquidations or monitoring your trade. This can be done with small investments and learning how to buy options.

|

| Trading with Exotic Markets | by ATC |

Ready to level up your trading?

First, what are the options?

Exotic Markets options are financial contracts that give you the right to buy/sell an asset at a predetermined price on a specific date.

Two types of options are available to use:

1- Call Options:

These give you the right to buy an asset at a predetermined price at the expiry date.

Example: $INJ is at $20, and you bet it will rise beyond the strike (buy) price at $25, let's say the price is $30 at the expiry date, you can buy at $25 and sell higher.

(you don't have to buy if the current price is below the strike price but you lose your payment).

2- Put Options:

These give you the right to sell an asset at a predetermined price at the expiry date.

Example: $INJ is at $20, and you bet it will fall beyond the strike (sell) price at $15, let's say price is $10 at the expiry date, you can buy at a lower price and sell at $15.

(you don't have to buy if the current price is above the strike price but you lose your payment)

Options vs. Futures: Key Differences

Options are a unique profile of risk offered within crypto but exotic markets have delivered a DeFi platform that is beginner-friendly to use

There is some risk in betting on which direction the price will go but buying these options contracts comes cheap.

The difference between options and futures trading is that risk is limited to only what you pay for the contracts, whereas futures trading losses can snowball if not managed right.

Ready to improve your trading strategy? Let's dive into our short tutorial on buying options on Exotic Markets.

Step one:

Visit Exotic markets, and connect a compatible wallet. Some favorites are Ninji Wallet, Leap Cosmos, Keplr Wallet, and MetaMask.

Step two:

Now head to the buy options tab at the top, If there are options available to buy they will show up here. Choose one that you think is most favorable by considering the current price, where the strike price is, and the expiry date.

These are all important factors to decide how confident you are in buying

Step three:

Choosing and buying a product. It doesn't take much $INJ to buy one contract and the rewards are larger than holding in spot.

Note this is a FCFS product, and there is a limited quantity of contracts available. If you're satisfied with your product then go ahead and buy.

Step four:

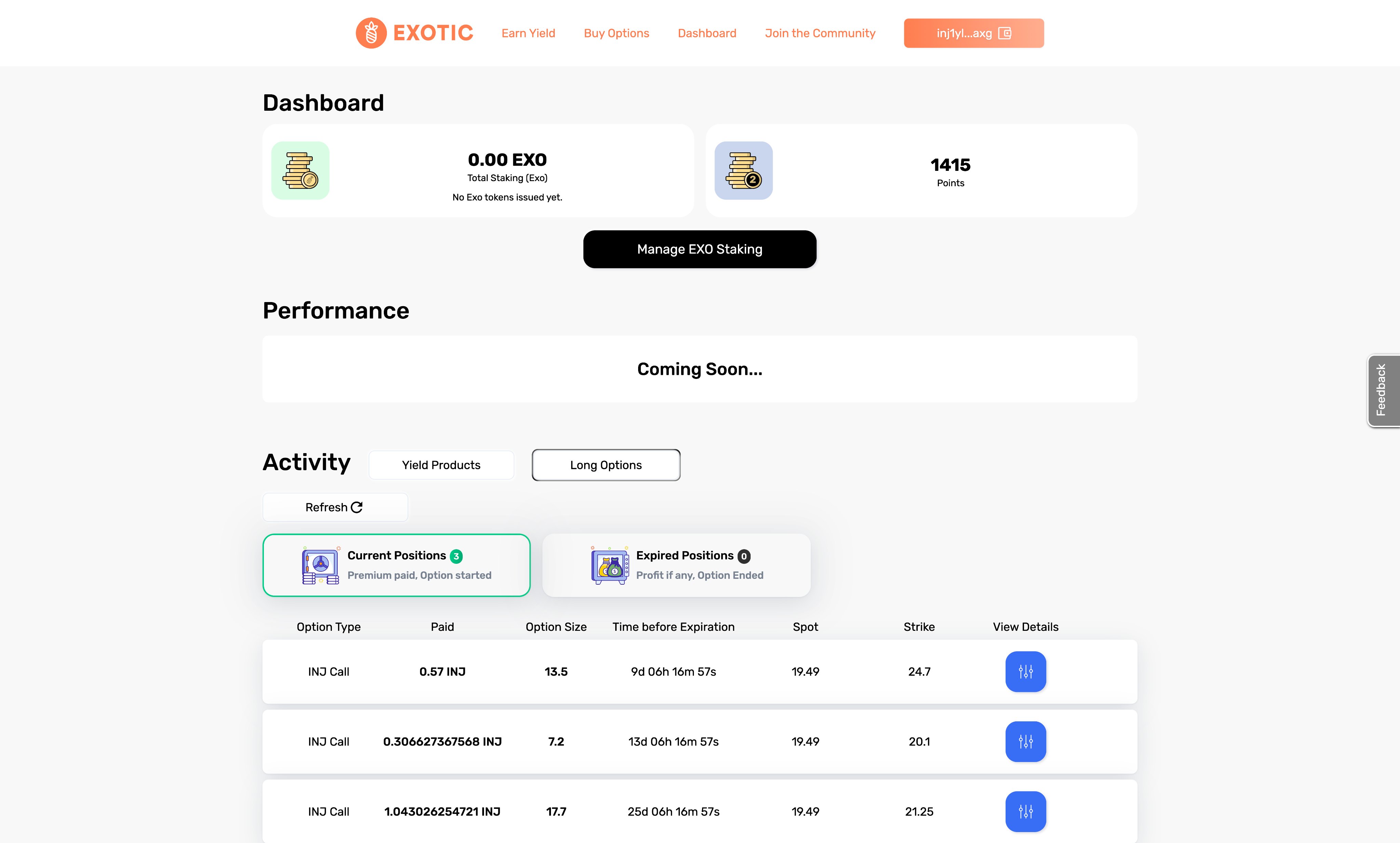

Finally, you’ll want to view your current or expired positions. Go to dashboard > long options to view both, This is the best place to keep track of each of your options and their expiry date.

Now you're all set to begin your new journey to mastering options on Exotic Markets.